Imagine that cross-chain bridges are like trains taking you from one destination to another, through different states. You can glimpse the importance of cross-chain bridges in a siloed blockchain ecosystem with that picture in mind. Think of them as trains taking you from one blockchain to another, allowing you to move assets and communicate with other blockchains, thereby increasing interoperability in a siloed blockchain ecosystem. All the aspects of the blockchain, from Decentralized Finance (DeFi) to Non-Fungible Token (NFT) and the Metaverse, are vastly siloed by design. This is for a good reason— to maintain security and sovereignty. However, the need for sovereignty is crucial; siloing stunts the progress of blockchain solutions. As the financial world continues to get disrupted by decentralized financial primitives, the need for interoperability and communication between independent blockchains becomes crucial to enable DeFi to scale to mainstream usage. In this article, we will look at cross-chain bridges and how they work.

What are bridges

https://fxcryptonews.com/what-is-a-crypto-bridge/

With so many NFT and Metaverse projects springing up, it is possible to hold different assets or collectibles across different blockchains. But how do you transfer your assets from one chain to another to explore their use cases? It is easier to convert the asset simply, but gas fees can sometimes be expensive and here is where cross-chain bridges come in. Bridges enable interoperable communication and interaction between vastly different networks, such as Cosmos and Ethereum. A bridge can also be used between one parent chain (Ethereum) and its sidechain (Ronin), which either uses a different consensus or inherits the security from the parent chain. Hence, cross-chain bridges are tools designed to enable interoperability by transferring data, assets, tokens, smart contract instructions, assets, or data between two independent blockchains.

Since the blockchain ecosystem is fragmented, each blockchain stands alone and assets are not compatible. Using cross-chain bridges, synthetic derivatives can represent an asset from another blockchain. For transactions to pass through a cross-chain bridge, two blockchains with different consensus algorithms, governance models, and rules must connect interoperably and securely.

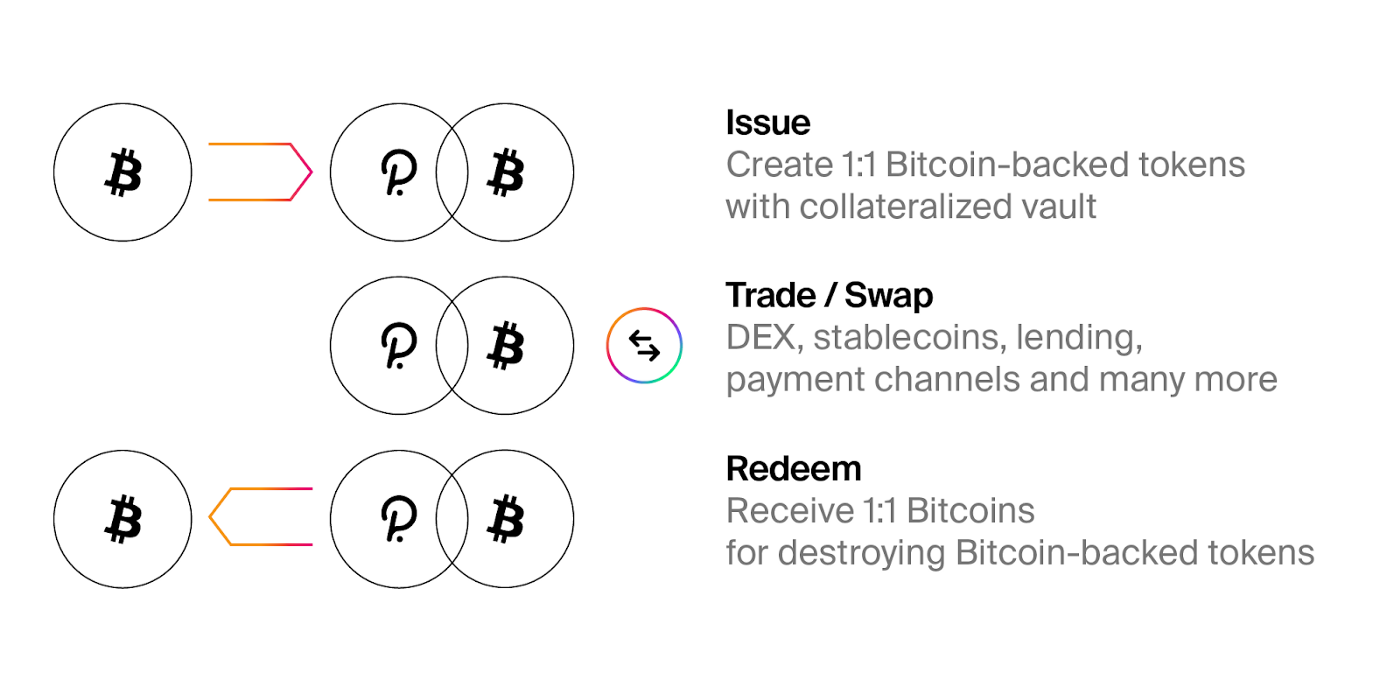

For instance, a typical Polkadot - Bitcoin bridge creates two-way communication between both chains.

Through this bridge, holders of an asset such as BTC can transfer their assets to another blockchain such as Polkadot using a synthetic derivative called PolkaBTC. Hence, when a DOT holder sends DOT through the bridge, he gets PolkaBTC, and the DOT is held in the vault of the bridge. Holders of PolkaBTC would then have to burn their assets to receive the equivalent BTC on the Bitcoin chain.

Through bridges, you can deploy assets hosted on one chain onto a dApp in another blockchain, leverage low-cost transaction fees available on less scalable networks and execute Decentralized solutions and Dapps across networks.

Bridging methods

There are two major designs for bridges

- Centralized/ trusted/ federated bridges

- Decentralized/trustless bridges.

Centralized/ Trusted bridges use a form of central authority to function. This means that there is a need for a third party to use the bridging application or service. Centralized bridges are easy to use especially for newbies. However, degens prefer trustless bridges for their wide range of offerings. Centralized bridges bear similar functions exchange, only instead of exchanging pairs, it just takes a token and sends you the same token on the destination network of your choice. For instance, using the OKX Bridge, users can convert their BTC and receive an ERC-20 compatible token.

Decentralized/Trustless bridges, on the other hand, make use of the arithmetic configuration of the underlying blockchain to create an open, transparent and decentralized system. Trustless bridges are used to channel liquidity across blockchains in a decentralized manner using smart contracts. Examples of trustless bridges are Multichain, formerly Anyswap, and Umbria Narni Bridge. These bridges enable asset transferal using liquidity pools across multiple chains.

How bridges work

Atomic swaps: One of the most secure and trustless ways of transferring digital assets to other chains. Atomic swaps enable the exchange of native assets of two separate blockchains without third-party interference through smart contracts. Atomic swaps can only occur when each party involved provides proof of acceptance through key encryption. An example of Atomic swaps is Startup, Lightning La, which uses the Bitcoin Lightning network for off-chain transactions.

https://www.bitpanda.com/academy/en/lessons/what-is-the-purpose-of-the-lightning-network-for-bitcoin

Lock and mint: Locking base assets and minting authentic assets to enable exchange is one of the most popular ways of bridging assets. A great example of this is ERC20-based tokens that can represent any asset on Ethereum. During lock and minting, remote bridging occurs between two blockchains where ‘Chain A’ locks its assets and generates a derivative on ‘Chain B’. When the holder of the assets in Chain B wants their original asset on chain A, they will have to burn the derivative on Chain B and then unlock them on Chain A. it is important to note that while bridging using this method, the amount and value of the tokens remain constant. Wrapped tokens are a great example of the Lock and mint method. For instance, Bitcoin can become WBTC as a synthetic asset on another chain.

https://blog.makerdao.com/what-are-blockchain-bridges-and-why-are-they-important-for-defi/

Liquidity Providers: Liquidity providers (LPs) can add their funds into a pool created on two different chains. Users of this pool can facilitate transfers between the two chains for a fee. In return, liquidity providers earn a fee for facilitating the transfers. Liquidity pools as a tool of cross-chain swaps are efficient and decentralized. The cross-chain swaps on the liquidity pool bridge are validated on the source and the destination chains, respectively. Assets are transferred from the vaults of the two chains, which are managed by LPs and validators on both chains.

https://www.bitdegree.org/crypto/learn/what-is-liquidity-pool-in-crypto

Summary

Cross-chain bridges bring a much-needed solution to the fragmented nature of the blockchain space. Innovators and developers in the space are able to build interoperable solutions between NFT networks using bridges as their needed cross-chain infrastructure. The main goal of cross-chain bridges is to push scalability in the industry where applications enjoy such services without giving up the original blockchain’s liquidity and network effect. For instance, Aura Network brings cross-chain bridging into the NFT industry enabling users to swap assets between EVM-based blockchain and Aurachain using the Aurabridge. The future of transfers on various siloed blockchain use cases such as DeFi, NFT and the Metaverse points to cross-chain. With the release of more innovative solutions, assets transferal in the industry will become efficient and easy on user-friendly interfaces.