What is the Carbon Protocol?

Carbon is a decentralized layer 2 cross-chain trading protocol engineered by Switcheo Labs, a software development lab focusing on decentralized applications with proven products such as ZilSwap and Demex. Carbon is built primarily to support the trading of sophisticated & advanced financial instruments such as options, bonds, and futures, at scale.

Main features

Decentralized Order books

The Carbon protocol's fully decentralized order books are a standout feature. It is a hybrid dex that allows for both order book trades similar to a CEX as well as an AMM similar to Uniswap.

Carbon enables fully automated and decentralized liquidity provision. Anyone can establish their liquidity pools while earning SWTH incentive awards.

Moreover, thanks to dPOS Order Matching Engine which ensures each validator node keeps a copy of the order matching engine and verify trade transaction correctly, Carbon can provide low latency on-chain order matching that completely eliminates front-running via a batch-based matching system across all markets.

Amplified Liquidity

This is a new feature of Carbon.

With the help of Carbon's enhanced AMMs module, liquidity providers can offer specific pricing ranges and custom liquidity levels, similar to Uniswap v3.

Money Market

A decentralized non-custodial lending and borrowing platform where users can participate as depositors (lenders), borrowers, or liquidators permissionlessly.

Cross-Chain Interoperability

Enhance interoperability between blockchains like Ethereum, Cosmos, BSC, Neo, and Zilliqa with cross-chain liquidity pools of Carbon via Poly Network bridge.

Carbon can also interact with other chains in the Cosmos ecosystem through IBC such as Cosmos Hub, Juno Network, Evmos, and Osmosis,...

Carbon Hub is a cross-chain solution enabling transfers of assets, without the need to create a Carbon account in the process. This empowers users to bridge SWTH between supported blockchains (such as BSC, Ethereum, Osmosis, Neo, and Zilliqa…) in just one transaction.

All cross-chain transaction data will be recorded at Carbon's Hydrogen Network. Currently, it is still in the first phase (dashboard which illustrates cross-chain transaction info). In the second phase, they will roll out a relayer network to ensure the safety and efficiency of the Carbon Protocol.

Liquidity pools

Carbon's liquidity protocol features public liquidity pools (LPs) and native automated market makers (AMM) for every market. Liquidity pools will feature flexible bonding curves so that liquidity can be used as efficiently as possible by the AMM and earnings can be maximized.

The protocol utilizes Balancer’s Constant Product Market Maker (CPMM) model for underlying liquidity pools allowing for users to, allowing users to contribute liquidity in different proportions (i.e. 30/70) as opposed to traditional LPs,

Anyone is able to create liqucans on Carbon via reference UI, Demex (a DApp of Carbon, a DEX that allows trading of complex financial instruments like futures, perpetual,... related to crypto)

Currently, a portion of block rewards is allocated to selected liquidity pools (via governance) as incentives for liquidity provision to ensure liquid order books on Demex. Specifically, a static 40% of block rewards are allocated to liquidity rewards, for a period of 12 weeks (until 17th February 2023), after which it drops to 0%.

Stablecoin and Stableswap

Carbon comes with its own overcollateralized stablecoin $USC that will have zero minting fee and low-interest rate and can be used as a margin when they launch cross-margin. This is a similar design to DAI of MakerDAO.

Additionally, stable swaps will be introduced to offer capital efficiency so that users can trade between various stablecoins and LSDs with little spread on their order books

Permissionless Listing: Anyone is able to create spot or futures markets on Carbon permissionless at a fee of 5000 SWTH, to list tokens and create markets via the “import token” feature on Demex.

Derivatives: Carbon already supports spot markets and dated futures on Demex, its reference UI, with up to 50x leverage. For Carbon's derivative markets, underlying price feeds can be created through oracles via governance which allows for the trading of assets trading ment, without needing to support the actual token itself. This allows for a variety of markets such as indexes, stocks, commodities, and non-digital assets to be traded via the Contract for Differences market (CFD).

Architecture

Carbon is a custom-built sidechain that utilizes underlying technology from Tendermint comprising:

- Tendermint Core, the BFT Consensus Engine

- Cosmos SDK, the Blockchain Application Framework

- IBC protocol, the Interchain Standard for Blockchain Communication

Carbon operates as a secondary framework that runs parallel to Layer 1 chains (i.e. Ethereum, Neo, Zilliqa), functioning independently while remaining anchored to their security.

⇒ This enables faster trades, lower fees, support of sophisticated financial instruments, advanced order types, and cross-chain communication.

Tokenomics

The $SWTH token is the native cryptocurrency and governance token of Carbon, and the maximum token supply is estimated at 2.16B SWTH tokens. Tokens are released every week as block rewards and after 5 years (March 31, 2025), no new tokens will be issued.

In Week 1, the emission of $SWTH began at a rate of 1.92%, decaying by 1.65% week-on-week. In the final Year 5, tokens will be issued at a constant rate (no decay).

Block rewards are distributed as follows:

- 50% - Stakers. View the staking APR on Carbonscan.

- 40% - Liquidity pool rewards on Demex.

- 10% - Community Fund and ground-up projects.

THE STATE OF CARBON

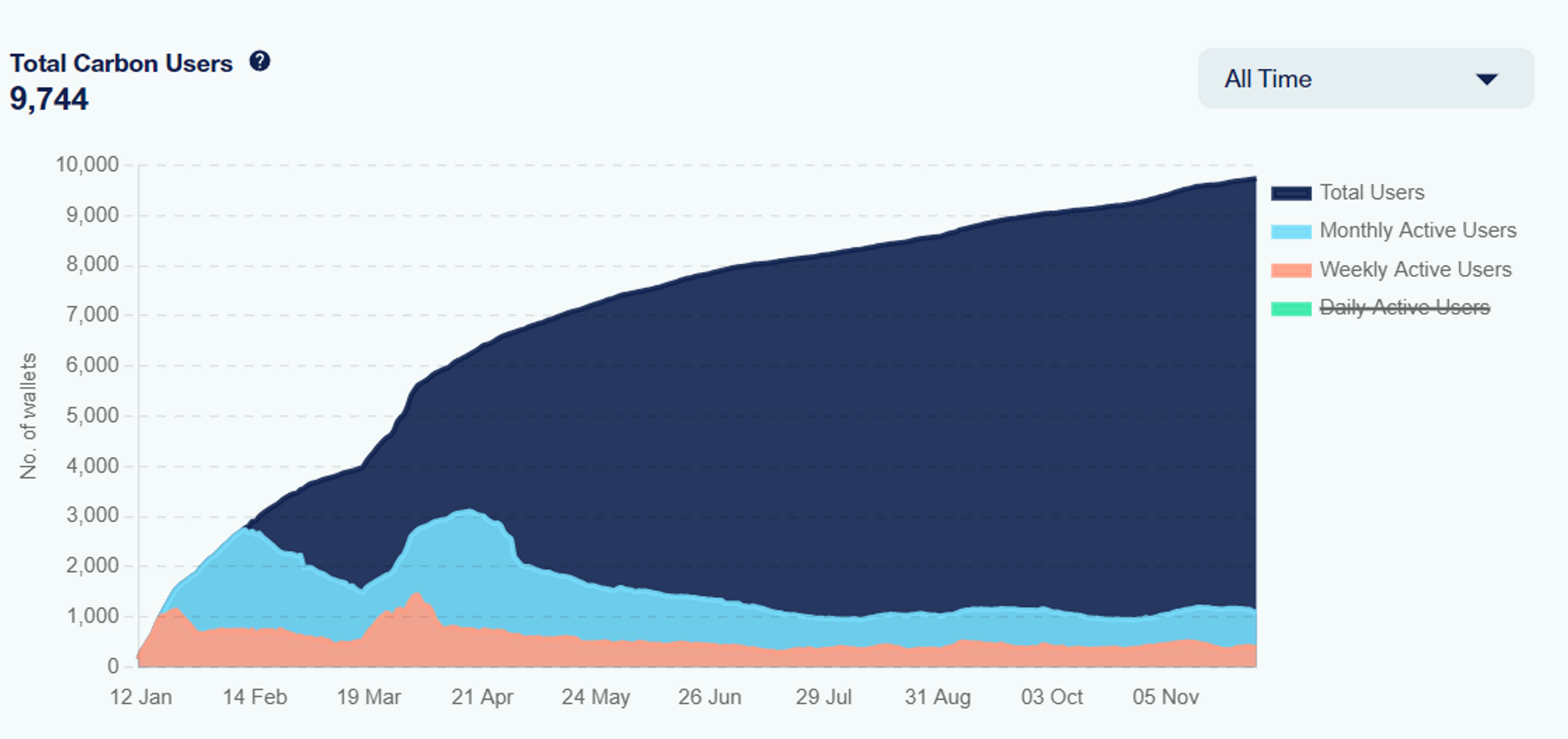

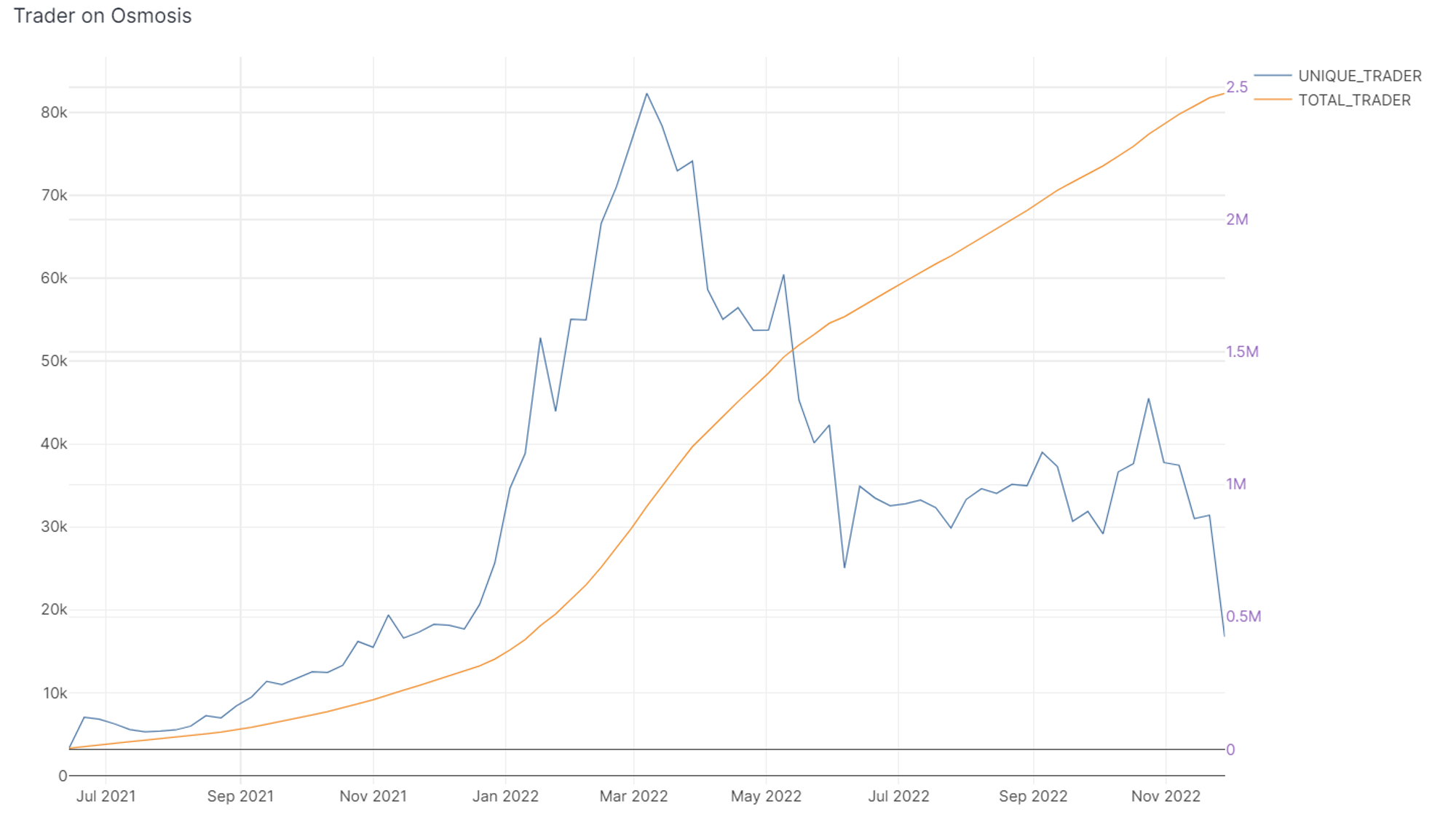

After a brief surge in the weekly number of users in March, it has plateaued around 500 - 600, while the total number almost reaches 10K. Compared that to Osmosis which has a cumulative 2,5 million traders and 10K weekly (though it has substantially dropped since the FTX fallout in November), we can see that Carbon does not have much adoption.

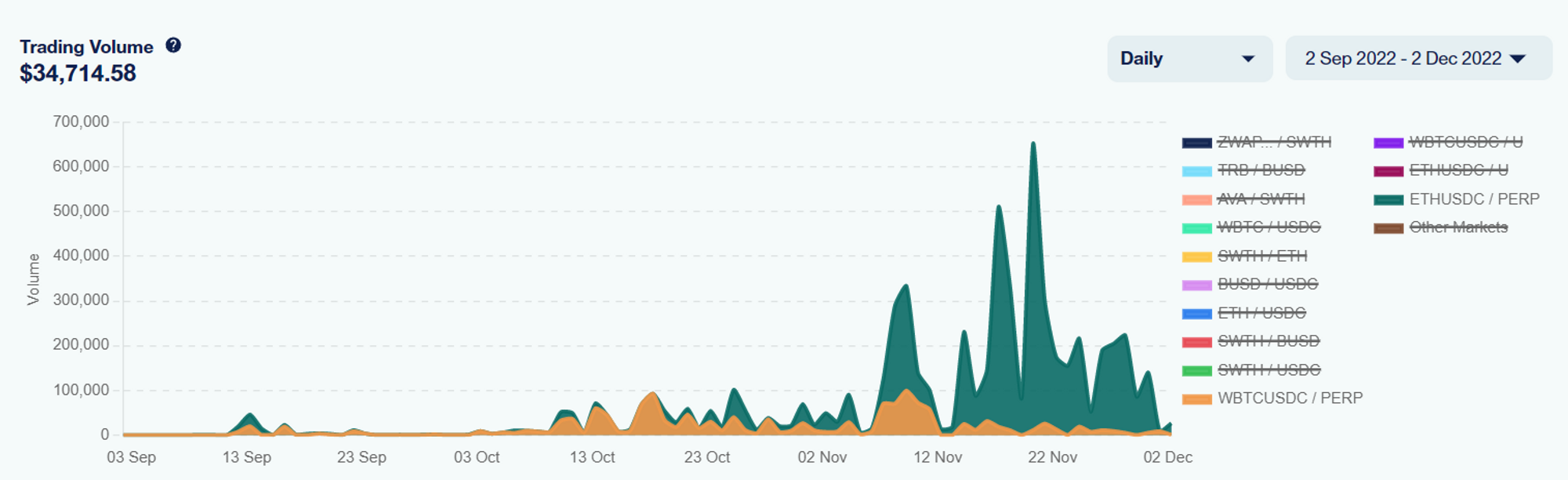

The main advantage Carbon has over Osmosis is that it allows for derivatives trading, yet on-chain data also paints a very bleak picture. The total trading volume for ETH - USDC Perp and WBTC - USDC Perp is just $34,7K. Interestingly, volume picked up from 10 to 22 November, which is not the exception as, after the FTX incidence, there has been a large inflow of money to perp DEX such as GMX, GNS …

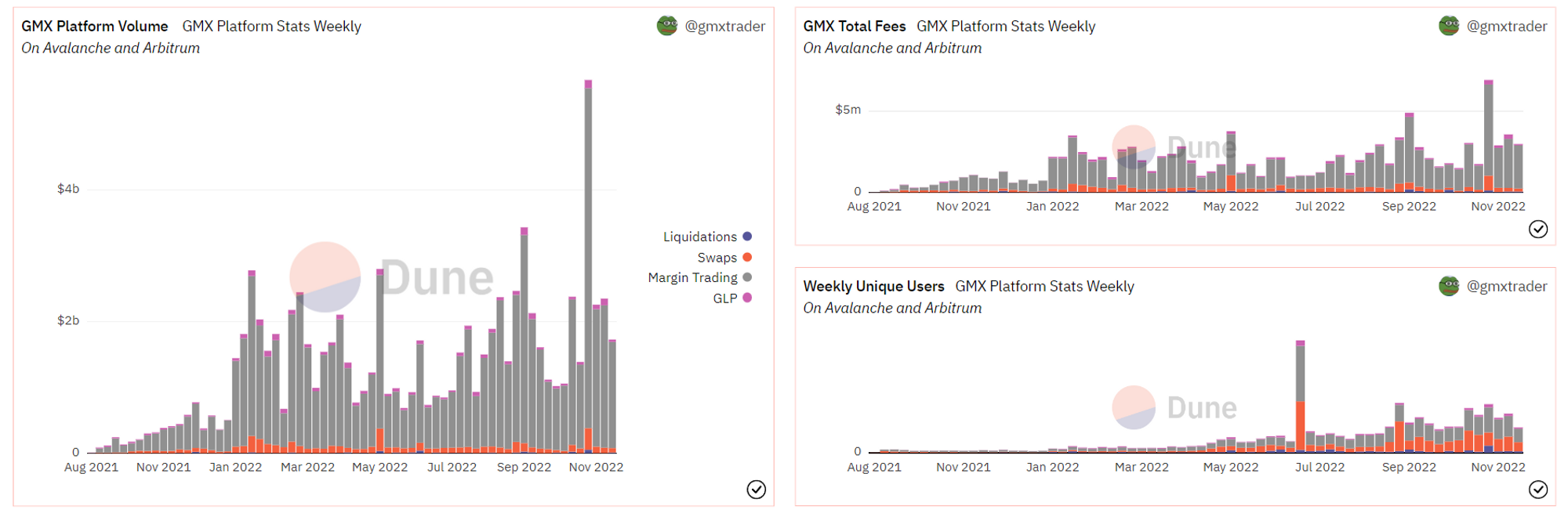

To be specific, looking at trading volume, fees and weekly unique users on GMX, we can see that there was also a large uptrend during the same period. Nevertheless, it seems that Carbon fails to retain users as volume has almost disappeared since December, while that of GMX only fell marginally.

Another major concern is the low number of active validators (13 out of 23) and a large number of SWTH was unstaked on the first week of November.

Currently, there are 5 validators in the process of unbonding, which are Zilliqua, Bora Bora Mob, SmartNodes, Neo EcoFund, and Neo Foundation. This could further centralize the chain and bring significant risks.

CONCLUSION

Despite the large inflow to Defi in general and Perp Dex following the aftermath of FTX, Carbon has failed to maintain a strong user base and has shown weaknesses to its competitors. The centralization of the platform is also a major concern.

Nevertheless, hope remains for the future with the upcoming launch of Nitron, a money market where you can borrow, lend, and mint the native stablecoin $USC. This could drive more revenue to the protocol through interest rate differences and liquidation fees. Recent proposal v2.14.0 has also introduced Amplified Liquidity which allows lower slippage and higher efficiency for traders.

Link: https://commonwealth.im/carbon-protocol/discussion/7840-cip23-v2140-software-upgrade-proposal

Let’s keep a close eye on Carbon!