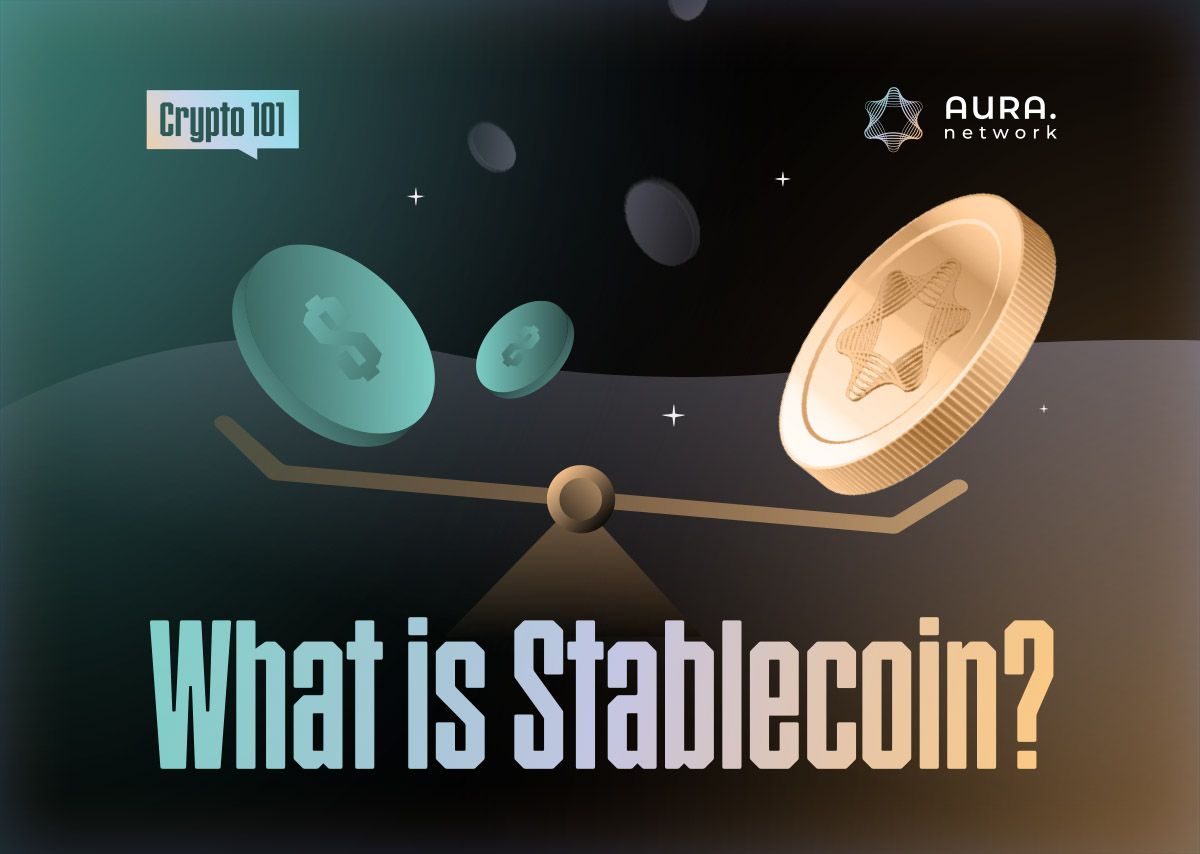

What is a stablecoin?

At its heart, stablecoins are cryptocurrencies that aim to maintain a peg to an underlying asset which is oftentimes stable in value. Most stablecoins peg to the US dollar as it is widely considered the most popular and liquid global currency (in fact, it makes up 60% of all known central bank foreign exchange reserves). For example, 1 USDT, a type of stablecoin that is pegged to US dollar, can be easily redeemed for 1 USD on most centralized exchange platforms.

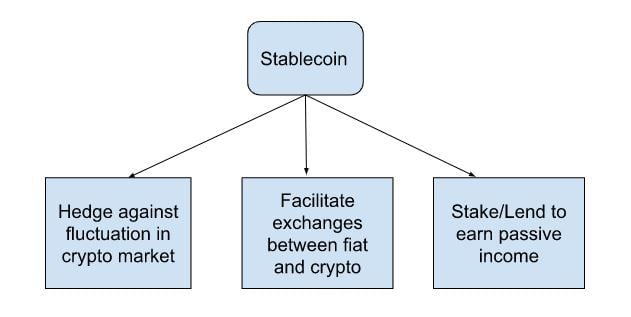

Why do we need stablecoins?

Stablecoin is an essential bridge between the traditional financial market and cryptocurrency world. It serves several purposes:

- Stablecoin is, by its name, stable. It can be used as a store of value to shield against fluctuation in the crypto market

- It facilitates trading on crypto exchanges. Instead of buying Bitcoin with fiat currency, traders can exchange fiat for stablecoins and then use stablecoins to buy Bitcoin.

- Stablecoins can be staked or lent out, yielding passive income for crypto investors. Interest rate varies with the state of the market, but with an average rate of 3% it offers a better rate of return compared to traditional USD lending rate (which is close to 0% before the pandemic)

How to create a stablecoin?

Imagine that you create your own stablecoin named YourStableCoin. How can you convince others that 1 YourStableCoin is equivalent to 1 US dollar? There are several ways to do this:

Fiat-backed stablecoin

For every YourStableCoin you issue, you put 1 US dollar in the treasury. You build a protocol that allows people to exchangeYourStableCoin to USD at the 1:1 rate. As long as you commit to back all of YourStableCoin by USD of equivalent value, in theory 1YourStableCoin should always be able to be redeemed for 1 USD.

In fact, that is exactly what Tether and Coinbase are doing. Tether launched USDT (Tether USD) in 2014, and it is the first and largest stablecoin with $80.46B market cap at the time of this writing. USDC, launched by Circle in collaboration with Coinbase in 2018, is the second largest overall with a $45.2B market cap at the time of this writing. Both of these coins were initially backed by US dollars, though over time the creators add some interest-bearing assets to the and lower the US dollars in the reserve. It is important that the 1-to-1 back is honored, and the creator’s treasuries are kept in check by regulators and auditors. Fiat-backed stablecoins cannot leverage on fractional reserves because the creators do not have cash flows in their business, and they simply act as intermediates who offer the stablecoin service in exchange for a fee each time their stablecoin is used. We can contrast this with traditional banking where fractional reserves are normal practice as banks can earn profit via borrowing-lending operation and cash flow management.

Crypto-backed stablecoin

Instead of backingYourStableCoin by fiat currency, you can back it by a cryptocurrency. You write a protocol where each time an user deposits some cryptocurrency, someYourStableCoin will be minted and issued to the depositor. Due to the volatile nature of cryptocurrency, it is necessary that the stablecoins are overcollateralized, which means that every $1 worth of cryptocurrency will return less than $1 worth of YourStableCoin.

DAI is the most successful in this category of stablecoins and is created by the protocol MakerDAO. MakerDAO is a lending protocol that gives out loans in DAI at a predetermined interest rate. Similar to the example above, users would deposit ETH as collateral and receive an amount of DAI, with each DAI being worth 1 USD. If the value of the collateral falls below the required amount to support the loan, users would have to pay the amount they borrowed plus a fee to get back their collateral. Inversely, if the value of the collateral rises, users are allowed to borrow more DAI. At the time of this writing, the market cap is about $7B

The collateralization rate dictates the security and efficiency of the protocol. A high collateralization rate offers a more resilient stablecoin against the market fluctuation, but reduces the efficiency of the cryptocurrency used as colleterization as it could have been used for other purposes such as staking or providing liquidity. The reserve is true.

Algorithm Stablecoin

You do not back YourStableCoin by any assets. Instead, you issue another cryptocurrency called YourToken, and you write out a protocol outlining the following mechanism: you can swap YourToken for an equivalent value of YourStableCoin, with YourStableCoin being taken as 1 USD regardless of the current price of YourStableCoin. This created an arbitrage opportunity for users whenever YourStableCoin decoupled from its USD peg. In such situations, users were incentivized to do swaps in the direction of arbitrage, maintaining the peg.

A prominent yet notorious example of Algorithm Stablecoin is Terra USD (UST) and Terra (LUNA), founded and developed by TerraLabs led Do Kwon. Terra’s system relies on traders burning or creating tokens for arbitrage profit to maintain its peg to the U.S. dollar. Every time a UST token is minted, the equivalent of $1 in market price in LUNA is burned, and vice versa. So when the price of UST drops below $1, traders are encouraged to burn UST, or remove it from circulation, and receive LUNA tokens at a discounted rate. Because there is less UST in circulation, the price should theoretically go up toward $1 again, maintaining the peg.

If the price of UST exceeds $1, traders are incentivized to burn $1 worth of LUNA in exchange for 1 UST (which is worth , which increases its supply and theoretically will eventually drop the price back to $1.

The exact mechanisms of other algorithmic stablecoins will vary but most if not all of them involve a burn/mint mechanism that’s similar to UST. This category of stablecoins are the riskiest of the bunch, with their peg largely backed by collective faith in the system, in addition to market forces. Once faith is eroded, they can quickly fall into a death spiral as users all rush to exit their positions on both the stablecoin and the main token used for the swaps, leading to cascading price drops on both assets.

How stable are stablecoins?

Let’s first look at the top ten stablecoin by circulating supply.

| ID | Name | Token | Circulating Supply | Pegging mechanism |

| 1 | Tether | USDT | 70,870,514,674 | Fiat-backed |

| 2 | USD Coin | USDC | 54,094,956,074 | Fiat-backed |

| 3 | Binance USD | BUSD | 17,422,532,790 | Fiat-backed |

| 4 | Dai | DAI | 6,877,596,218 | Crypto-backed (ETH) |

| 5 | TrueUSD | TUSD | 1,221,391,305 | Fiat-backed |

| 6 | Pax Dollar | USDP | 945,642,940 | Fiat-backed |

| 7 | Neutrino USD | USDN | 816,795,686 | Algorithmic (WAVES) |

| 8 | USDD | USDD | 723,321,765 | Algorithmic (TRX) |

| 9 | Fei USD | FEI | 424,966,178 | Algorithmic (ETH) |

| 10 | Gemini Dollar | GUSD | 408,684,430 | Fiat-backed |

Table 1: Top ten stablecoin by circulating supply (data collected on June 15 2022 from coinmarketcap.com)

We can see that the top three stablecoins account for the majority of the market, amounting to 93% of all circulating stablecoin in supply. These three coins are all fiat-backed. Dai is the only Crypto-backed stablecoin in the list. The rest of the list is the mixed of three types of pegging mechanisms. A take away from this table is that fiat-backed stablecoins are dominating the market and expect to continue this dominance in the near future.

Next, we plot the prices of these stablecoins in USD to see how well they maintain the peg across time.

We can see that in fact most stablecoins deviate from its $1 USD peg at least by some margins over their lives. The most notable cases are GUSD which deviated 3 times at a 10% margin in late 2018 and early 2020, and USDN which plummeted by more than 15% in value in Q2 of 2022. The remaining coins are relatively stable whose value fluctuates but barely fall outside the 3% bandwidth (the dash horizontal lines). Moreover, these coins revert to its peg rather quickly if deviations occur.

Let’s dive further by plotting these series by pegging mechanism, starting with fiat-backed stablecoins:

BUSD is the most stable among this category, followed by USDC and USDP, GUSD and TUSD occasionally lose the peg. USDT fluctuated quite widely when it was first released, but remains largely stable since 2019.

Algorithmic Stablecoin is a new concept which was introduced in 2019, and widely adopted in 2020. USDN is one of the early adopters that maintains in the top-ten list for a reason: it remains stable for more than a year after seeing the plummet as mentioned before. Meanwhile, FEI has a rough debut, yet manages to revert its peg a few months after release. USDD is the new player to the market so time will tell.

DAI is the only Crypto-backed stablecoin in the top-ten list. The fact that it is backed by Ethereum makes it a resilient stablecoin despite the fluctuation of the crypto market. DAI does experience lots of short-term volatility early 2020 but it tames the wild in Q3 2020 for which it remains significantly stable afterwards.

A takeaway from this analysis is that Fiat-backed stablecoin seems to be the most stable, with BUSD being the most stable among others. Algorithm stablecoin is the second runner (UST is a notorious outlier). Crypto-backed stablecoin offers only one candidate in the top-ten list, yet its stability is admirable.

Conclusion

Stablecoin is a promise, and its existence relies on how well it can deliver such promise. Stablecoin is an essential bridge connecting the traditional financial market to the crypto world. As such, it is also an Achilles heel whose weakness can unfavorably shake the crypto market. TerraUSD is such an example whose total market value reached $18B at some point, and its collapse brought much grim to the crypto market. Each pegging mechanism has its own strength and weakness. Investors should do diligence when making an investment decision with stablecoins.

![[EN] AURA NETWORK presents: THE NFTs TALK](/content/images/size/w1200/2022/07/The-NFTs-talk.png)